· 7 min read

Everything you need to know about $ANZ

The public release of ANZ begins with a launchpad sale on Dec 2

The public release of ANZ begins with a launchpad sale on Dec 2, on Fjord Foundry and Starship, along with Anzen’s Season 1 community airdrop right after.

Here’s what you need to know about the token.

TL;DR

- z-points lead to an allocation in ANZ airdrop! The z-points campaign will end in the first week of December. You will be able to check your airdrop allocation right after.

- A total of 5% has been allocated to z-points holders.

- The top 500 wallets, ranked by z-points, will follow a vesting schedule: 50% of their ANZ will be liquid at launch, with the remaining 50% vesting over six months to promote long-term alignment.

- $ANZ Launchpad Sale will be conducted through Fjord Foundry and Starship as a Fixed Price Sale (FPS).

- With the launchpad sale, airdrop, and listing, $ANZ tokens will become fully transferable, paving the way for $ANZ staking and exchange listing

Achievements

- $92 million TVL across chains.

- Number 3 stablecoin on Base by market cap, after USDC and DOLA

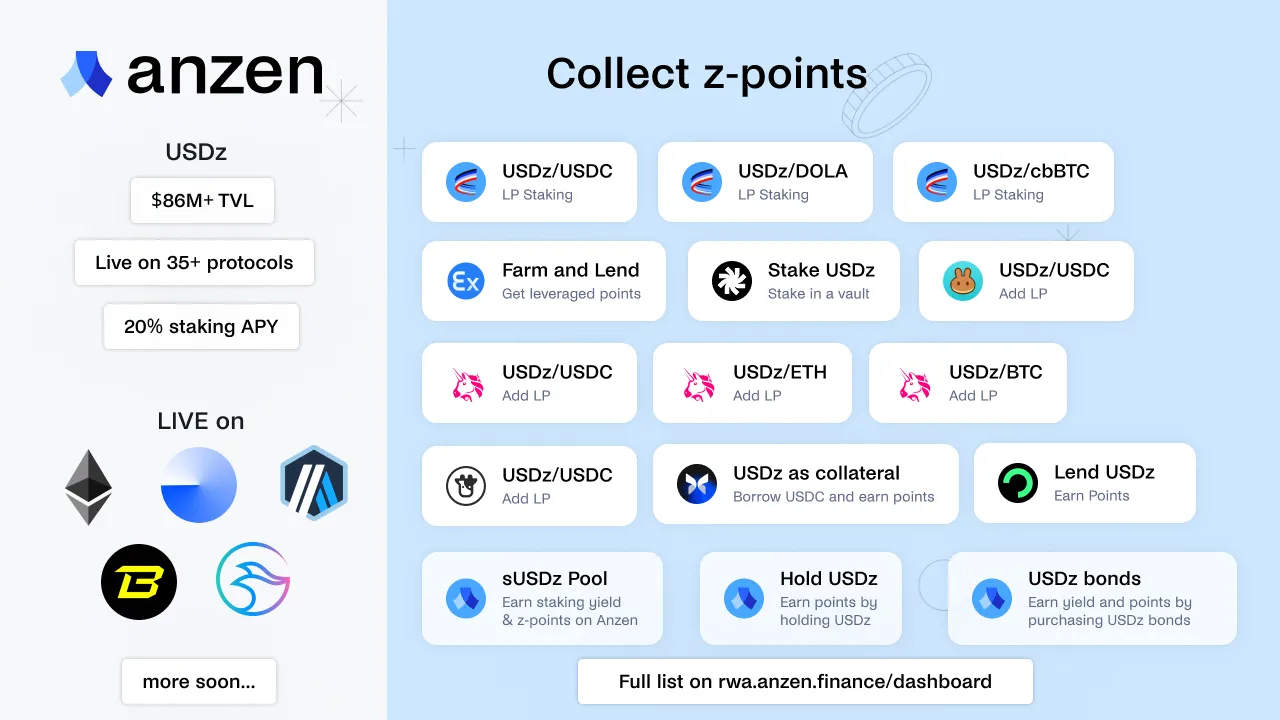

- USDz and sUSDz integrations across 35+ partners including Aerodrome, Pancake Swap, Beefy Finance, Extra Finance

- Upcoming expansion to multiple chains including Movement, Berachain, Mantra, Monad, Initia

- First fully composable RWA stablecoin with Defi compatibility for leveraged looping and lending/borrowing on protocols like Morpho and Silo Finance

- First RWA stablecoin providing non-cyclical, sustainable rewards

- Community partnerships with Jumper, Pudgy Penguins, Doodles, SpaceID, OneID

- The Future Is Multichain

The Future Is Multichain

USDz can be seamlessly bridged across multiple chains. We started USDz on mainnet, branching into Base, Manta, Blast, and Arbitrum.

We are excited to announce that USDz is planned to go live on Movement, Berachain, Plume, Mantra, Monad, Initia, and more in the near future.

Anzen Fundamentals

The total TVL of on-chain stablecoins sit around $178B (source). Total Value Locked (TVL) measures the assets deposited in a crypto protocol via staking, lending, or liquidity. A high TVL indicates strong user confidence and engagement, serving as a key metric for a project’s health and competitiveness in DeFi and blockchain.

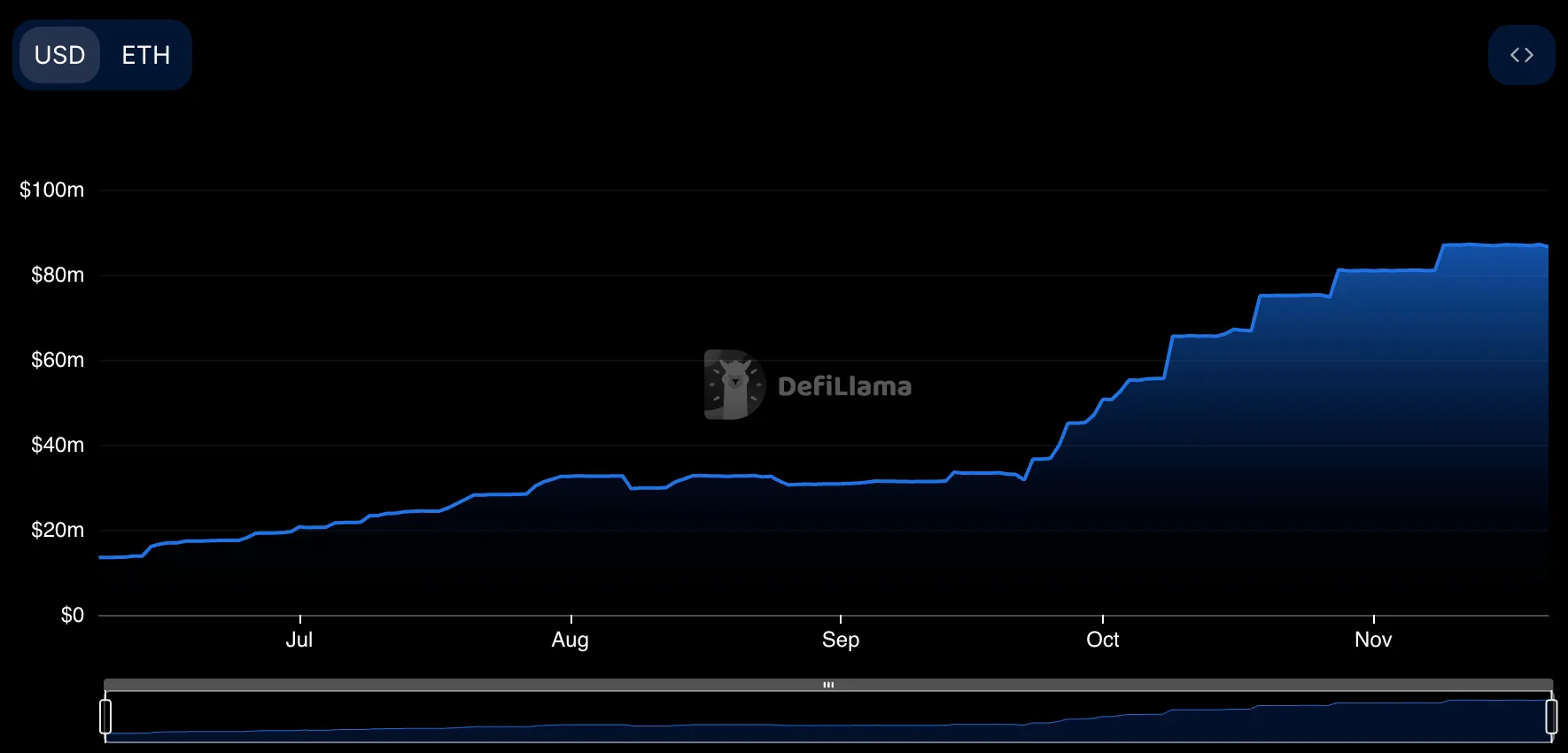

As of this writing, Anzen’s TVL stands at $92 million (source), with month-over-month growth exceeding 25% since launching USDz in June 2024. This growth rate positions Anzen as the fastest-growing RWA and stablecoin protocol in the space.

Anzen’s exponential growth shows its strong product-market fit within the DeFi ecosystem.

Anzen’s Staked USDz (sUSDz) currently offers an 12-15% effective base APY, providing uncorrelated, non-cyclical yields. These returns stem from a diversified portfolio of asset-backed securities. Leveraging a well-established network and over a decade of experience in capital allocation and asset management, Anzen’s founding team sources oversubscribed deals with market-leading, risk-adjusted returns to serve as the collateral for USDz. With token incentives, the base APYs will be boosted to create even more attractive yield opportunities for DeFi users.

sUSDz currently ranks as a top yield-bearing token, thanks to its high yield looping strategies on platforms like Silo, Morpho, and Ionic. The value of Anzen’s RWA-backed structure lies in its off-chain asset-backed securities, which maintain value and stability even during crypto market volatility.

Lastly, Anzen secured $4 million in seed funding from leading investors, including Mechanism Capital, Circle Ventures, Frax, Arca, Infinity Ventures, Cherubic Ventures, Palm Drive Ventures, M31 Capital, Kraynos Capital, and others.

| Protocol | FDV | Market Cap |

|---|---|---|

| Ondo | $9,970,000,000 | $1,390,000,000 |

| Centrifuge | $220,000,000 | $200,000,000 |

| Maple Finance | $221,000,000 | $97,000,000 |

| Usual | $1,050,000,000 | $129,000,000 |

| Ethena | $7,840,000,000 | $1,490,000,000 |

| Anzen | $60,000,000 | $6,000,000 |

We’re preparing to launch on Fjord and Starship at a fully diluted valuation (FDV) of $60 million. Early participants in this sale will have the opportunity to purchase ANZ at this initial valuation. Given Anzen’s growth trajectory as a newly established protocol, this valuation compares favorably to other protocols in the RWA and stablecoin space.

Tokenomics

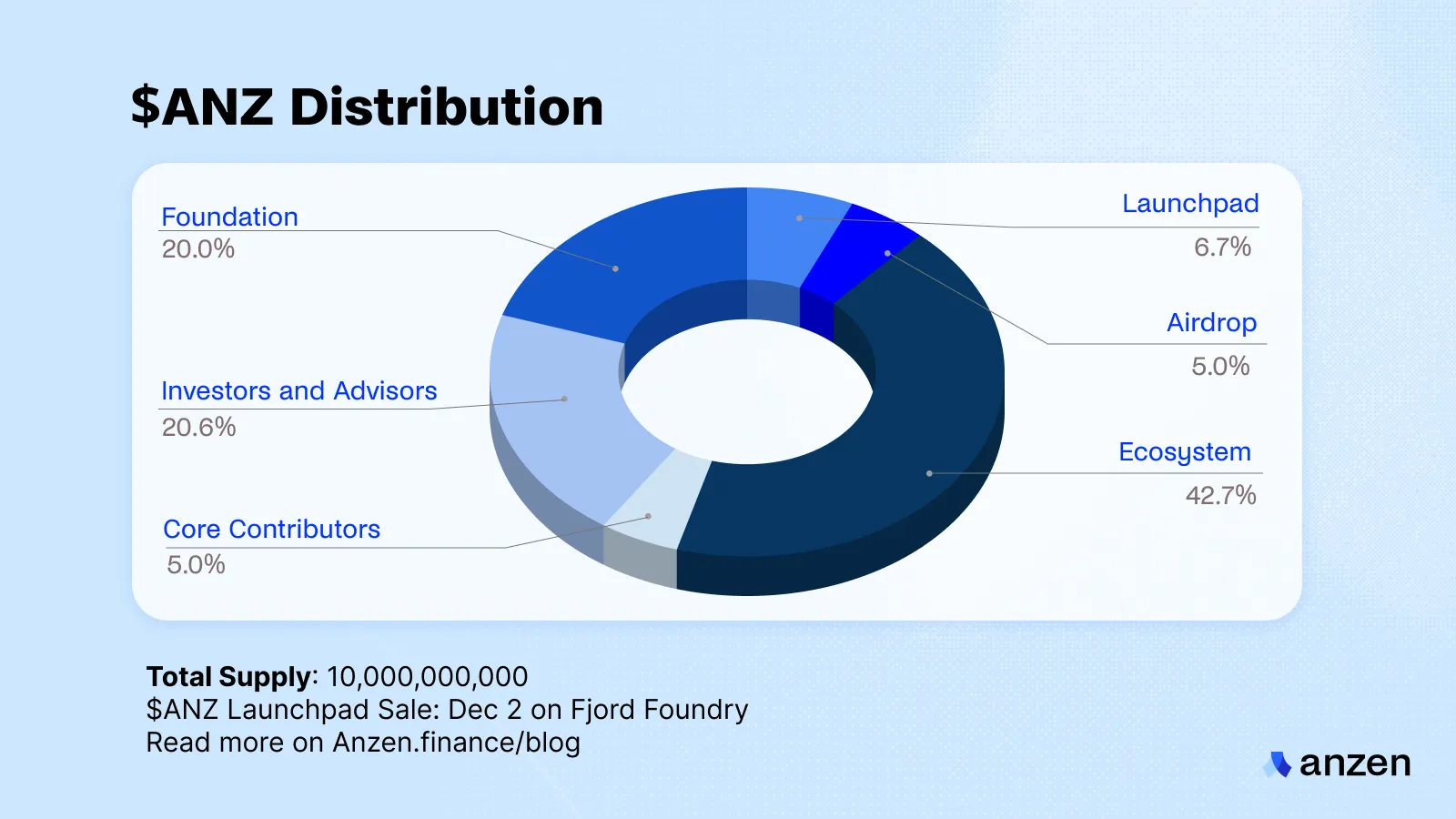

Anzen’s tokenomics are designed to decentralize the platform and reward users who have contributed to growing the Anzen ecosystem.

- What’s the ticker? $ANZ

- Total Supply: 10,000,000,000

- Initial Circulating Supply: 9.8%

- Investors & Core Contributors have 6-month cliff and 24-month linear vesting

- The Ecosystem portion will be emitted on an epoch-based schedule over 7 years to Anzen users

| Allocation | Percentage |

|---|---|

| Community Airdrop | 5.0% |

| Ecosystem Rewards | 42.7% |

| Launchpad Sale | 6.7% |

| Investors & Advisors | 20.6% |

| Core Contributors | 5.0% |

| Foundation | 20.0% |

Community Airdrop: 5%

Allocated to users who contributed to the initial growth of the Anzen ecosystem. There is no vesting on the airdrop except for the top 500 wallets which will have 50% vested over 6 months.

Investors: 20.6%

Investor allocations are subject to a 6-month cliff from TGE, followed by a 24-month linear vesting.

Core Contributors: 5%

Anzen core contributors are subject to a 6-month cliff from TGE, followed by a 24-month linear vesting.

Foundation: 20%

The Foundation allocation is for partnerships and long-term initiatives to grow the Anzen ecosystem.

Ecosystem: 42.7%

The ecosystem portion will be used for reward emissions to users, including USDz stakers, USDz-USDC LPs, and USDz Bond holders. This ensures that ecosystem participants are rewarded for contributing to protocol TVL growth, and they have influence over the protocol

Launchpad Sale: 6.7%

- Venue: Fjord Foundry and Starship

- Date: Dec 2, 2024

- Allocation: up to 6.7% of total token supply (666,666,666 $ANZ), Fully Unlocked.

- Sale Limit: $3M hard limit Fixed Price Sale, $60M fully diluted valuation (FDV).

- Duration: 7 days

- More Details: Part of the funds raised from the public sale will be earmarked for market-making to support liquidity.

How will the sale work?

ANZ will be launched via a fixed-price sale (FPS).

A Fixed Price Sale (FPS) is a common method for token distribution, where a set percentage of the total supply is sold. Tokens are sold at a fixed price for the duration of the sale. After the sale ends, the raised funds are transferred to the protocol, and tokens are distributed to participants.

The ANZ sale will take place on Fjord Foundry and Starship, and last for 7 days: from Dec 2, 13:00 UTC to Dec 9, 13:00 UTC.

A total of up to 666 million ANZ tokens will be offered at $0.006 per token, fully unlocked. This sets the fully diluted valuation at $60 million, and based on estimated circulating supply the market cap would be approximately $6 million.

We selected Fjord as the premier token sale platform. Together, these platforms have helped projects raise nearly $1 billion.

The Anzen sale is curated, meaning it has an official curator, vetted by the Fjord’s team, who conducts thorough due diligence on the team and product.

ANZ Vesting

The top 500 wallets—ranked by z-points—out of the total users eligible for ANZ distribution will be subject to a vesting schedule. 50% of their allocated ANZ will be fully liquid at launch, while the remaining 50% will vest over a 6-month period to encourage long-term alignment.

Tokens will vest linearly and be claimable at the end of each month following the initial airdrop, subject to the conditions outlined below.

Smaller holders outside the top 500 wallets by points count will have no vesting restrictions on their tokens.

In summary, vesting the locked allocation depends on the user’s continued participation in the Anzen ecosystem. This participation is measured by ensuring a user’s wallet balance of USDz doesn’t fall below the balance on the airdrop date. This is determined on a wallet-by-wallet basis, and users’ wallets will not be aggregated for this purpose.

To clarify: the vesting is pro-rata. If a user sells USDz after the initial airdrop, resulting in their balance being 10% lower than the airdrop, for example, they will lose only 10% of their unvested ANZ—not the full amount.

ANZ Token Utility

ANZ will be used to govern and grow the Anzen protocol and ecosystem.

Holders will benefit from:

- Liquidity Incentives

- Exclusive ANZ-Holder features

- Base Rewards

- Protocol Fees

- Voting for Pool Incentives

More details on ANZ utility will be shared in the near future.

Path Forward Phase 1 (Q4 2024)

The path forward is to first deepen USDz’s integration into the crypto ecosystem and provide more utility to USDz holders. Being able to use USDz as a currency for high yield strategies is key to significant TVL growth.

- Morpho - Lending market

- Silo - Lending market

- Contango - Looping (in progress)

- Pendle - Lending / Yield market

- Reserve - Yield bearing Tokens