· 3 min read

Introducing the Anzen OTC Market

Empowering Market Makers and Strengthening USDz Stability

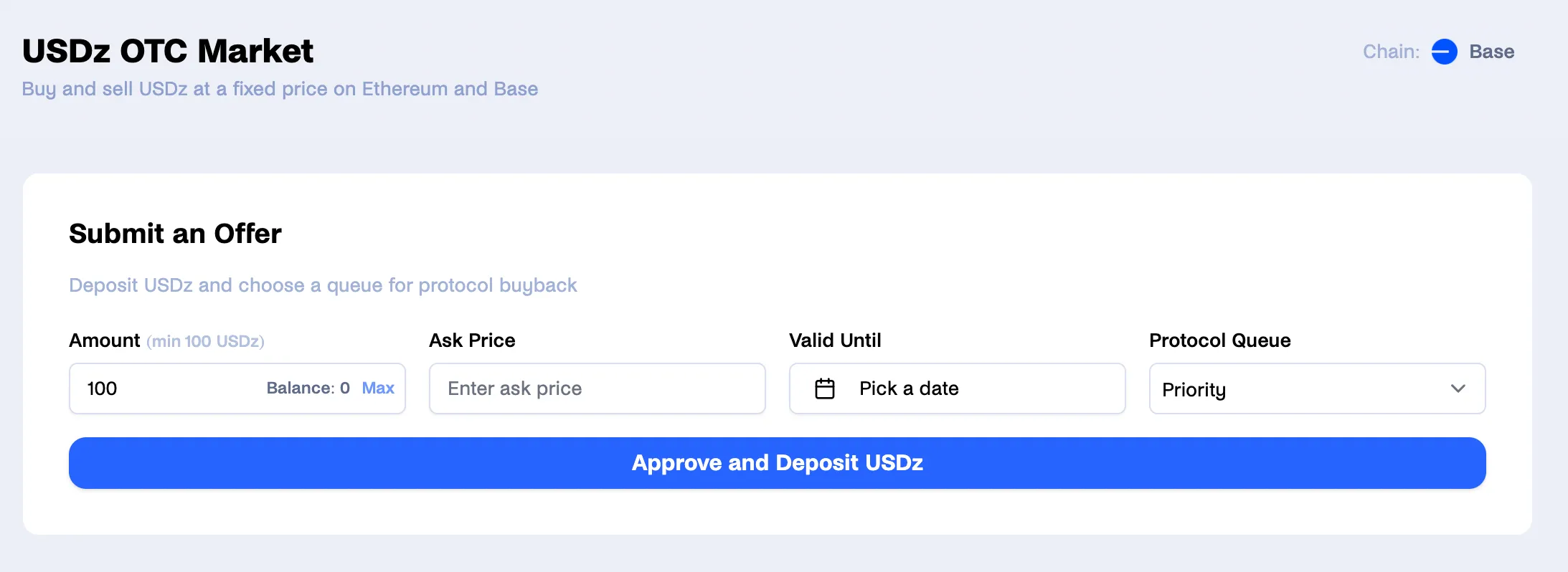

We’re excited to announce the launch of a new Over-the-Counter (OTC) Market for USDz. This innovative mechanism provides a permissionless platform where users can buy and sell USDz with zero slippage, reinforcing Anzen’s commitment to stability, liquidity, and user empowerment.

The OTC Market is a pivotal feature designed to stabilize the USDz price by offering a transparent and robust pathway for buybacks. It allows anyone, including the protocol itself, to seamlessly trade USDz while meeting diverse liquidity needs.

The OTC Market is deployed on Base and Ethereum.

A Market for Everyone: Buy, Sell, and Make Markets

USDz is backed by institutional-grade real-world assets (RWA), which most users are not allowed to redeem for directly. The OTC Market bridges this gap by decentralizing market making, allowing users to trade USDz efficiently while retaining the yield-generating power of RWA.

Unlike traditional systems where only the protocol takes action, any user can participate in market making and profit from arbitrage opportunities.

Here’s how it works:

- Buy and Sell USDz Permissionlessly

- Users can trade USDz directly, without slippage, creating a frictionless market for price discovery.

- Earn Arbitrage Profits

- Market participants can buy USDz from DEXs at a price below 1 USDC, hold it, and resell at a higher price, earning profits along the way.

The Protocol’s Role: Allocating Buyback Capital

As the OTC Market operates permissionlessly, the protocol itself may also participate when capital is available. When the protocol deploys capital, it uses a dual-queue system to allocate resources transparently and efficiently:

- Priority Queue

- Allocation: 70% of available capital

- Purpose: Supports users who require immediate liquidity.

- Standard Queue

- Allocation: 30% of available capital

- Purpose: Rewards users waiting in queue, with a bonus APY accruing while order is unfilled.

When the protocol executes buybacks, it allocates capital across queues based on three transparent criteria:

- veANZ Balance: Higher stakes in governance tokens receive priority.

- Ask Price: Competitive pricing is rewarded to optimize capital efficiency.

- Order Creation Date: First-come, first-served within the same priority.

Important Note: The queues only matter when the protocol itself deploys capital for buybacks. The market remains open for anyone to participate independently, regardless of the protocol’s actions.

Why This Matters

Empowering Users to Stabilize USDz

The OTC Market democratizes market making. By allowing anyone to participate, it creates a decentralized and transparent ecosystem where users can contribute to stability while earning arbitrage profits.

Protocol Buybacks as a Supporting Role

While the protocol may allocate buyback capital between the queues, this mechanism is a complementary tool. The primary innovation lies in enabling users to drive the market independently.

Yield Opportunities for Long-Term Holders

For users participating in the Standard Queue, additional incentives are available in the form of bonus APY while waiting in queue. For example, USDz purchased at 0.99 USDC and sold two weeks later for 1 USDC would yield an effective 34.5% APY (including a 5% APY queue bonus).

A Self-Regulating, On-Chain System

The OTC Market is fully permissionless—anyone can participate. Buyers and sellers interact directly, with the protocol serving as one of many players in the ecosystem. Users can choose their queue based on their preferences, creating a dynamic, self-regulating marketplace.

What’s Next?

The USDz OTC Market is live and open for everyone. Explore its features and see how it can fit your needs. We’re also committed to refining the system over time, ensuring it continues to meet the demands of our growing community.

Visit the OTC Market at https://app.anzen.finance/usdz-market, on Base and Ethereum.