· 2 min read

Anzen Launches USDz Vaults

A New Fixed Yield, Fixed-Term Investment Opportunity for Institutional Users and Stable Farmers

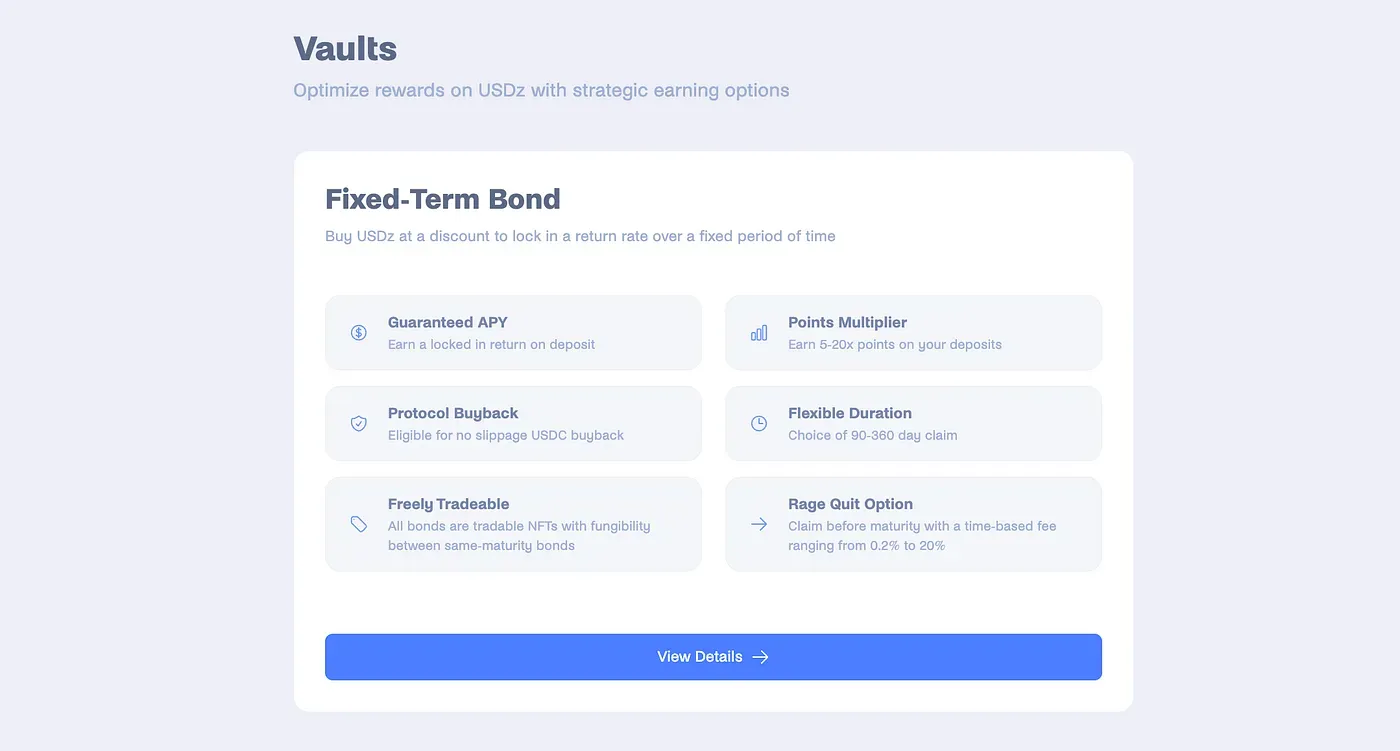

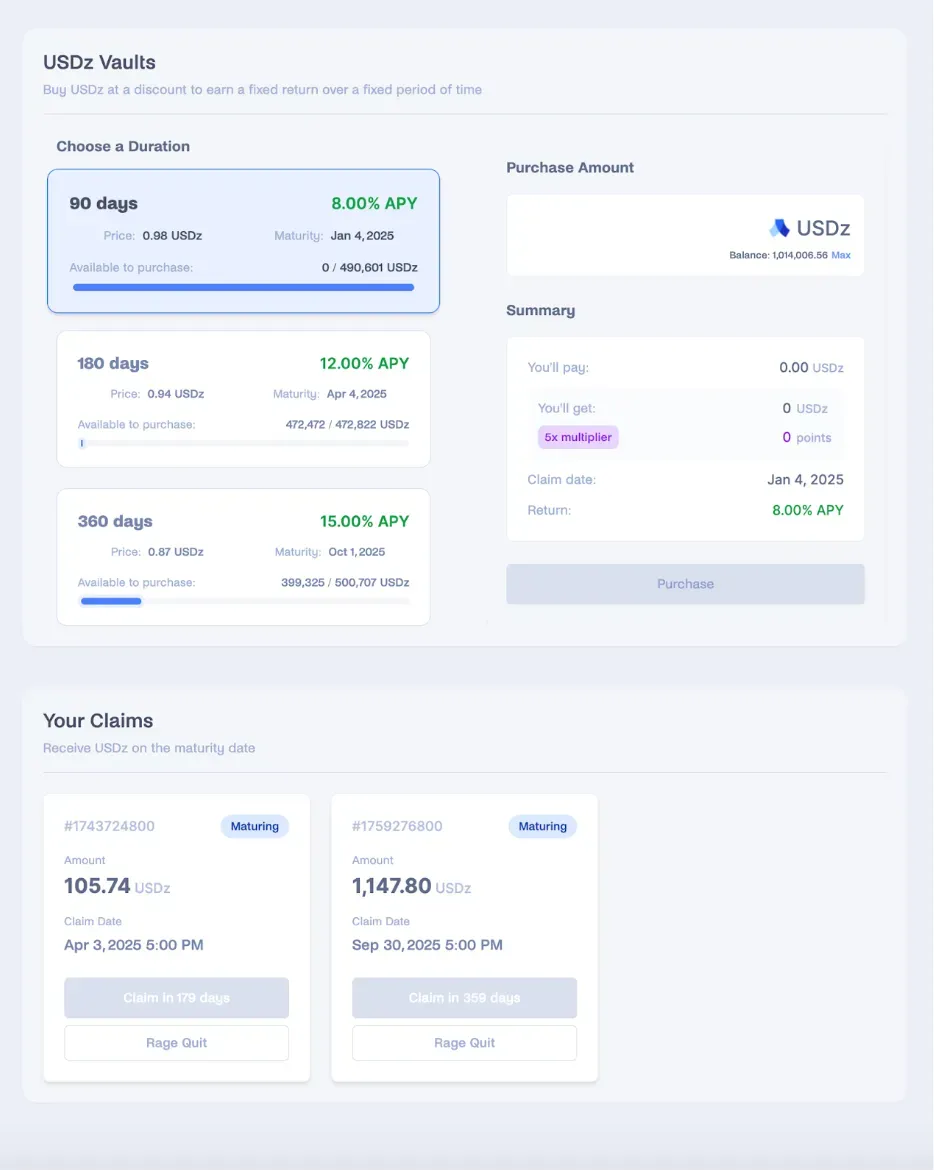

We are excited to announce the launch of USDz Vaults, an innovative product designed to offer institutional users and long-term farmers greater certainty and flexibility in yield farming. With the introduction of these fixed-term vaults, users can now lock in guaranteed returns, while enjoying additional features that enhance both liquidity and reward potential.

USDz Vaults: Certainty and Flexibility

The USDz Vaults are tailored for investors seeking predictable returns over a fixed period, providing a reliable alternative to more volatile yield farming strategies. Vault participants will also benefit from an upcoming protocol buyback feature at a 1:1 rate to USDC with no slippage. This feature is designed to meet the anticipated high demand for USDz Vaults, effectively eliminating liquidity pressure on decentralized exchange (DEX) pools.

Additional Rewards and Efficient Capital Allocation

Beyond the fixed yield, USDz Vault participants will enjoy a points boost, offering additional rewards to enhance their overall returns. By committing to longer lock-up periods, users enable Anzen to allocate capital more efficiently, creating an optimized portfolio that benefits the entire protocol.

Early Exit and Secondary Market Liquidity

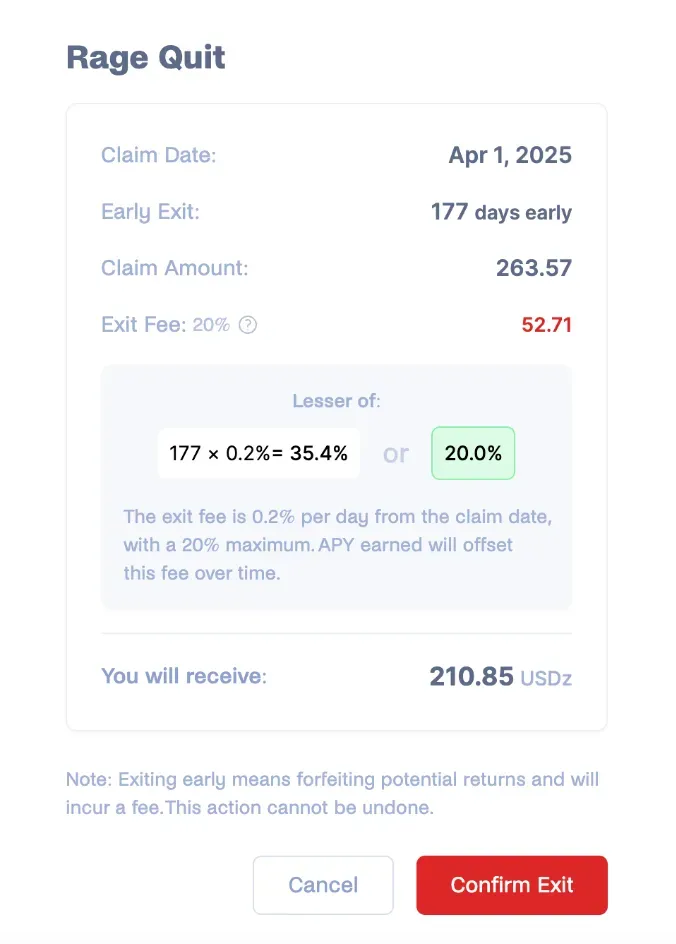

Understanding the need for flexibility, Anzen has built a “rage quit” option into USDz Vaults, allowing users to exit their positions early, subject to a fee. Additionally, all vault positions are tokenized, meaning users can freely buy or sell them on the secondary market, providing liquidity and flexibility at any time.

We believe USDz Vaults will be a game-changer for yield farming, especially for those looking for stability and enhanced rewards. The combination of fixed returns, flexible exit options, and the upcoming buyback feature makes USDz Vaults a robust choice for any institutional investor or long-term farmer.

Further details on the protocol buyback feature and how it integrates with the wider Anzen ecosystem will be announced in the near future.